January saw the closing date for the Provisional Local Government Finance Settlement consultation. This consultation currently shows that rural communities receive 37% less in central government funding than urban communities. This is an outrage! Rural communities have a high percentage of elderly residents reliant upon local services. Anyone who lives in a rural area will tell you that our local councils struggle to fund public services, especially transport. Add to this that rural NHS services receive the lowest Market Forces Factor (MFF) uplift on tariff in the country.

To explain what this means: PbR Tariff (Payment by Results – in reality payment by activity) applies a standardised value to every hospital procedure, dependent upon the number of the level of co-morbidities (other illnesses) and complications (CC) that a patient may have.

Example:

Major Hip Procedure with no other health complications £5,127

Major Hip Procedure with 10+ score for CC £11,417

This payment to the hospital would be the same at every NHS hospital in England BUT…

The Market Forces Factor is then applied. This is a multiplier used when calculating how much each trust gets paid for each activity. They all start with 1, to ensure no negative payments (so kind!), with a decimal point, and a further figure. So for example, if a trust’s MFF is 1.1, their tariff payment would be 10% above the standard rate.

Let’s examine the league table of best and worse MFFs:

Drum roll please……

Top Ten MFFs

| Great Ormond Street Hospital For Children NHS Foundation Trust | 1.225985 |

| University College London Hospitals NHS Foundation Trust | 1.214699 |

| Guy’s And St Thomas’ NHS Foundation Trust | 1.194070 |

| Moorfields Eye Hospital NHS Foundation Trust | 1.192804 |

| Tavistock And Portman NHS Foundation Trust | 1.185374 |

| Chelsea And Westminster Hospital NHS Foundation Trust | 1.185083 |

| Imperial College Healthcare NHS Trust | 1.182113 |

| Camden And Islington NHS Foundation Trust | 1.175750 |

| Whittington Health NHS Trust | 1.175103 |

| Central London Community Healthcare NHS Trust | 1.172153 |

| Royal Free London NHS Foundation Trust | 1.171498 |

Bottom Ten MFFs

| United Lincolnshire Hospitals NHS Trust | 1.016195 |

| Royal Cornwall Hospitals NHS Trust | 1.015857 |

| Hull University Teaching Hospitals NHS Trust | 1.014998 |

| West Midlands Ambulance Service NHS Foundation Trust | 1.014778 |

| Wye Valley NHS Trust | 1.014082 |

| Devon Partnership NHS Trust | 1.012641 |

| Humber Teaching NHS Foundation Trust | 1.011993 |

| Cornwall Partnership NHS Foundation Trust | 1.005688 |

| Northern Devon Healthcare NHS Trust | 1.005120 |

| Torbay And South Devon NHS Foundation Trust | 1.002648 |

Well, wouldn’t you know it! All the trusts that receive the most money are based in London, and all of the trusts that receive the least money are rural.

So taking the example that we looked at before:

Major Hip Procedure with no other health complications Torbay and South Devon £5,141

Major Hip Procedure with no other health complications Great Ormond Street £6,286

Major Hip Procedure with 10+ score for CC Torbay and South Devon £11,447

Major Hip Procedure with 10+ score for CC Great Ormond Street £12,816

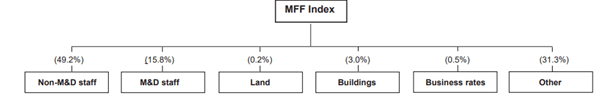

How is the MFF calculated?

By using the MFF Index

Non-M&D staff

The non-medical staff element is the single largest component of the MFF.

Although the staff index is intended to reflect non-medical NHS staff cost variations, it is based on private sector rather than NHS wages.

So this means if you are in a location where wages are high, the NHS trust gets paid more money. Yes, this makes sense, if you need to compete for staff in a local area. But hold on, doesn’t that mean that if you want to work at a trust that can afford to pay you more money, you need to work in London? Doesn’t it also mean that trusts in rural areas struggle to recruit the best qualified and experienced staff, because they can’t afford to pay them what they would get in an urban area?

M&D staff

Cost of medical and dental staff

Land value

What is the value of the land on which the trust’s property sits. The value of land is lower in rural areas, fact.

Buildings

The value of trust buildings same applies.

However, as you will see from the bottom ten MFFs, these calculations are used for ambulance trusts, and community trusts, that deliver community services. I fail to see how the fact that your community health building is worth less than a community health building in Hammersmith impacts on your costs of administering a service. In Hammersmith there is subsidised, frequent, convenient public transport. In Rural areas services need to be delivered over large areas, by healthcare professionals in vehicles, on poorly maintained roads BECAUSE Central Government don’t give rural councils enough money.

The whole system is grossly unfair and disproportionate.

Next time someone working in Westminster is considering retiring to a “rural idyl” please remember rural communities need services, they need services provided across a wide geography with added associated costs of transportation. If you don’t fund it now, you won’t want to retire to it later.

As this is one of my pet bug-bears, if you’d like to discuss at any time, please contact us.